‘No Deal’ Brexit and its Implications on the Validity of A1 forms

June 11, 2019

By: Kristine Zaiceva

As things now stand, on 31 October 2019 the UK would no longer be an EU Member State and in a no-deal Brexit scenario, EU legislation would immediately cease to apply between the UK and the EU from that day. For companies moving their employees between the UK and the EU, this would have a significant impact from both an immigration and social security cost perspective.

Currently, based on EU social security legislation, UK companies sending their employees on a temporary basis to another EEA Member State (or vice versa) can continue to pay social security contributions in the Home country (UK) and request an A1 certificate, that provides evidence of the ‘applicable (social security) legislation’ (e.g. UK) during the assignment to the Host country authorities, and exempts the company and its employee from social security contributions in the Host EEA Member State.

In principle, as of Brexit day, the UK would be treated as a non-EU country and consequently, would lose all the benefits provided by the EU legislation, including the right to request and obtain an A1 certificate for their posted workers, cross-border workers, and business travellers. Instead, the national social security legislation of each individual EEA Member State will dictate how social security compliance should be guaranteed whether exemptions apply, or if dual social security contributions will be due.

State of Play with Regards to Social Security Legislation

As the risk of a no-deal Brexit is still very real, it may be beneficial to highlight the current state of play with regard to which social security legislation will apply to moves and travels between the UK and the EU, as from Brexit day.

There are a number of ‘old’ Bilateral Social Security Agreements concluded between the UK and some EU Member States before the UK accessed the European Union in 1973. These agreements, in theory, could be “revived”. However, there is a large consensus among the Member States that these agreements no longer reflect current mobility patterns, and contain outdated provisions no longer fit for purpose.

Moreover, amongst the contingency measures proposed by EU Regulation 500/2019 in the event of a no-deal Brexit, there are no provisions related to Title II of the EU Regulations on the coordination of Social Security systems, that is, where an individual will be subject to social security contributions, and whether a certificate of coverage (A1 form) is still possible or valid. Based on the above, many Member States have developed national contingency measures to manage the social security consequences of a ‘hard’ Brexit. However, the approach taken by each Member State differs considerably.

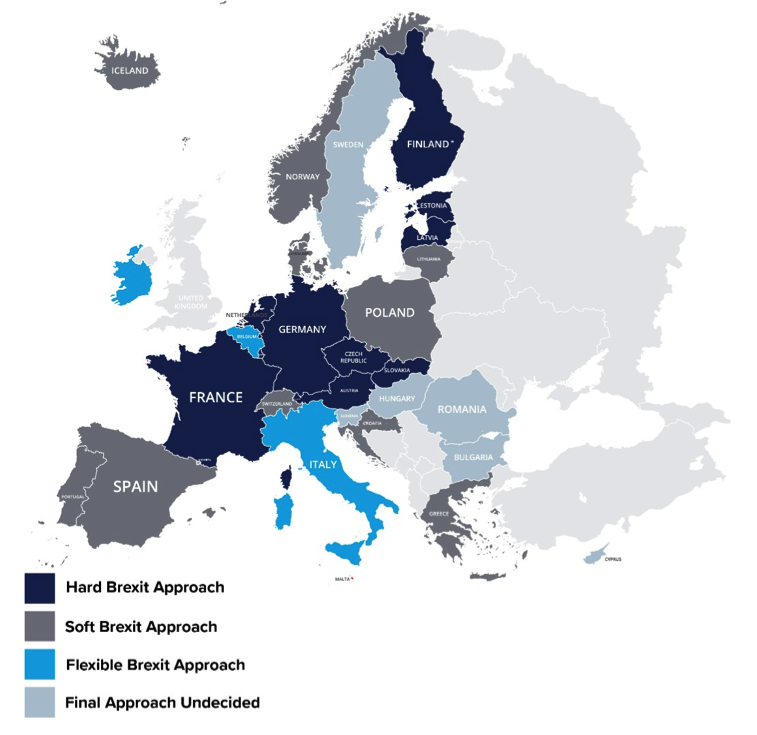

There are, broadly 3 approaches taken by different Member States with regard to A1 certificates:

- The Flexible Approach - accepting A1 certificates issued by the UK before Brexit and continuing to accept and issue new certificates after Brexit during a certain ‘grace period’ (which based on the national implementing measures of some Member States will last until December 31st, 2020). This approach is taken by countries, who prefer to see the UK as any other EU member state for social security purposes, e.g. Belgium and Italy; or countries where new bilateral agreements have been concluded, such as Ireland.

- Soft Brexit Approach – accepting A1 certificates issued before the Brexit date until the validity end date stated on the certificate, but not accepting any new A1 certificates issued after the Brexit date. Theoretically, as soon as issued certificates expire, local social security contributions would be due. This approach is favoured by Spain, Portugal, Iceland, Denmark, Lithuania.

- Hard Brexit Approach – not accepting A1 certificates already issued by the UK as of the Brexit date. This means local social security contributions could be due immediately unless an exemption under national legislation is possible. This approach may lead to double social security contributions. This approach is favoured by France, Germany, Luxembourg, and the Netherlands.

Our Heat Map below illustrates the various positions taken by the EEA Member States in respect of the validity of A1 forms at this point of time, according to the abovementioned 3 categories.

Conclusive Remarks

Fragmented solutions proposed by the Member States are likely to create an array of difficulties. As an example, multi-state workers could become subject to different approaches depending on the countries they work in. Additional planning would be required for existing and upcoming assignments to ensure all workers remain compliant in each Member State from a social security perspective.

Fragomen can assist you to prepare a strategic plan for your European assignments and business visitors’ ensuring that your eligible employees continue to benefit from A1 certificates where possible, and avoiding any additional administrative burdens and excessive costs for your company.

For more information please contact us at [email protected].

The information contained herein is current as of June 2019. It is offered for informational purposes only and does not constitute legal advice. Should you have any further questions please contact your Fragomen representative.