Countries / Territories

- 🌐

Related offices

- Atlanta, GA

- Auckland

- Beijing

- Bengaluru

- Boston, MA

- Brisbane

- Brussels (Benelux)

- Chicago, IL

- Miami, FL

- Dallas, TX

- Doha

- Dubai (DIFC)

- Frankfurt

- Hong Kong

- Houston, TX

- Irvine, CA

- Johannesburg

- Kochi

- Kuala Lumpur

- London

- Los Angeles, CA

- Matawan, NJ

- Melbourne

- Mexico City

- Nairobi

- New York, NY

- Perth

- Phoenix, AZ

- Rio de Janeiro

- San Diego, CA

- San Francisco, CA

- San Jose

- São Paulo

- Shanghai

- Sheffield

- Silicon Valley, CA

- Singapore

- Sydney

- Toronto

- Detroit, MI

- Washington, DC

- Zurich

Related offices

- Atlanta, GA

- Auckland

- Beijing

- Bengaluru

- Boston, MA

- Brisbane

- Brussels (Benelux)

- Chicago, IL

- Miami, FL

- Dallas, TX

- Doha

- Dubai (DIFC)

- Frankfurt

- Hong Kong

- Houston, TX

- Irvine, CA

- Johannesburg

- Kochi

- Kuala Lumpur

- London

- Los Angeles, CA

- Matawan, NJ

- Melbourne

- Mexico City

- Nairobi

- New York, NY

- Perth

- Phoenix, AZ

- Rio de Janeiro

- San Diego, CA

- San Francisco, CA

- San Jose

- São Paulo

- Shanghai

- Sheffield

- Silicon Valley, CA

- Singapore

- Sydney

- Toronto

- Detroit, MI

- Washington, DC

- Zurich

Related offices

- Atlanta, GA

- Auckland

- Beijing

- Bengaluru

- Boston, MA

- Brisbane

- Brussels (Benelux)

- Chicago, IL

- Miami, FL

- Dallas, TX

- Doha

- Dubai (DIFC)

- Frankfurt

- Hong Kong

- Houston, TX

- Irvine, CA

- Johannesburg

- Kochi

- Kuala Lumpur

- London

- Los Angeles, CA

- Matawan, NJ

- Melbourne

- Mexico City

- Nairobi

- New York, NY

- Perth

- Phoenix, AZ

- Rio de Janeiro

- San Diego, CA

- San Francisco, CA

- San Jose

- São Paulo

- Shanghai

- Sheffield

- Silicon Valley, CA

- Singapore

- Sydney

- Toronto

- Detroit, MI

- Washington, DC

- Zurich

Last week I had the privilege of addressing 100 or so members of the UK's growing tech community. It was a really interesting and energised group, working on everything from virtual reality to innovative marketing.

It was also diverse in terms of experience. The larger portion of the audience consisted of tech whizzes from outside the EU, trying to understand how they can stay in the UK and ply their trade. We also had company founders, HR managers and investors.

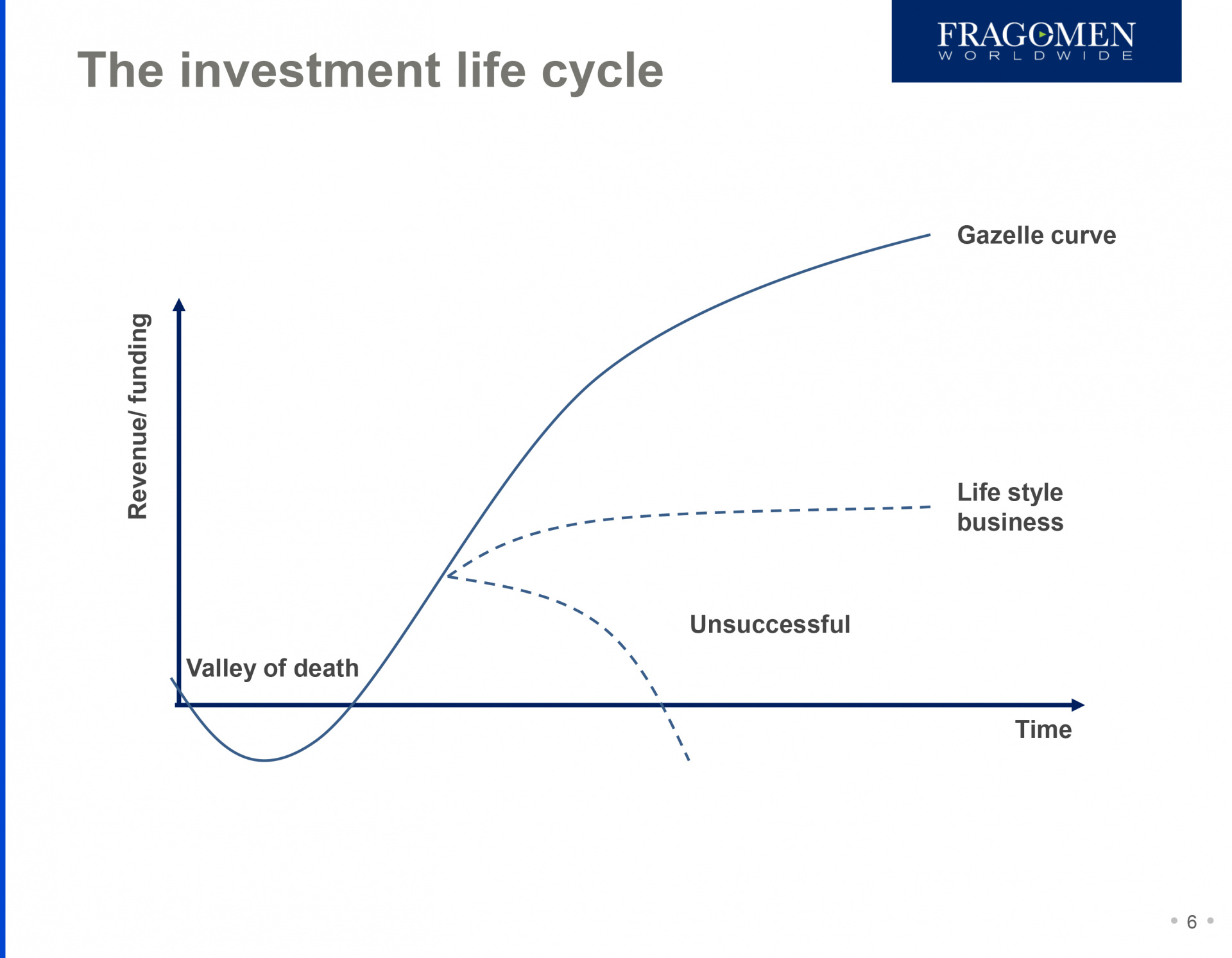

The question then was -- how can you help a diverse group understand the visa system, whether in a ten-minute slot or in this blog? I decided to use the investment life cycle, a useful chart I found about six years ago.

Stages of the investment life cycle and immigration

The investment life cycle taught me that entrepreneurs start in what some call, ominously, the valley of death. Others call it sweat stage. This is where you are living hand to mouth, spending more money than is being brought in.

The UK visa system doesn't cater for every foreign entrepreneur during sweat stage. The government doesn't want to give free reign to everyone who can claim to have a good business idea. They do however cater for some with the Graduate Entrepreneur visa.

Graduate Entrepreneur status is available for two years to people who have completed their studies here and want to start a business. As always there is a control, and those young entrepreneurs need to be endorsed by a university. Can any university endorse them? No, but the list is pretty long.

Those who survive the valley of death can then move on to the Entrepreneur visa category. There are three main requirements here:

1. Funding: Normally £200k but you can rely on £50k from a prescribed investor (e.g. a seed competition) or from any legitimate source if you are switching from the graduate entrepreneur visa.

2. Genuineness: The Home Office does not want people masquerading as entrepreneurs to use the category. Be prepared to show your credentials and your business plan.

3. Job creation: Not an unreasonable requirement. The Home Office wants to see you are creating jobs before they extend your stay or give you a settlement.

As a company begins to scale up, possibly becoming a lifestyle business, it may need overseas expertise. That is where sponsorship comes in.

Companies can sponsor non-EU workers where there are no suitable resident workers available. First time around this can be a slow and cumbersome process -- to begin with you need a sponsor licence and the application can take one to three months to compile, submit and have considered. You are then looking at a two to nine weeks wait for a Certificate of Sponsorship or visa.

Once you have the licence things can move more quickly although you will normally need to advertise any permanent roles for 28 days before you can recruit from overseas. You might again need to wait two to nine weeks for a Certificate of Sponsorship and visa if the person is not in the UK.

Then we get to the people who really have made it, those who achieve a steep gazelle curve on the investment life cycle. If you are willing and able to invest £2,000,000 in the UK you can get an Investor visa and then permanent residence in five years. If you invest more it can be accelerated--£5,000,000 means permanent residence in three years, £10,000,000 gets you there in two years.

Personally, I would just buy an island somewhere and create my own visa system.

Last of all we have the Tech Nation visa. This is for the most exceptionally talented people in tech, whether on the coding or the business side (or both).

I'll write more about tech nation next week -- it deserves a piece by itself. But, essentially, if you are a leading person in your sector or think you could be a leading person, you can apply for an endorsement from Tech City. If their experts agree you can then apply to stay in the UK on that basis.

The UK system doesn't capture everyone who wants to stay and work in tech. But you have a decent chance of finding an option if you understand where you are against the investment life cycle.

Learn more about Ian Robinson.

Countries / Territories

- 🌐

Related offices

- Atlanta, GA

- Auckland

- Beijing

- Bengaluru

- Boston, MA

- Brisbane

- Brussels (Benelux)

- Chicago, IL

- Miami, FL

- Dallas, TX

- Doha

- Dubai (DIFC)

- Frankfurt

- Hong Kong

- Houston, TX

- Irvine, CA

- Johannesburg

- Kochi

- Kuala Lumpur

- London

- Los Angeles, CA

- Matawan, NJ

- Melbourne

- Mexico City

- Nairobi

- New York, NY

- Perth

- Phoenix, AZ

- Rio de Janeiro

- San Diego, CA

- San Francisco, CA

- San Jose

- São Paulo

- Shanghai

- Sheffield

- Silicon Valley, CA

- Singapore

- Sydney

- Toronto

- Detroit, MI

- Washington, DC

- Zurich

Related offices

- Atlanta, GA

- Auckland

- Beijing

- Bengaluru

- Boston, MA

- Brisbane

- Brussels (Benelux)

- Chicago, IL

- Miami, FL

- Dallas, TX

- Doha

- Dubai (DIFC)

- Frankfurt

- Hong Kong

- Houston, TX

- Irvine, CA

- Johannesburg

- Kochi

- Kuala Lumpur

- London

- Los Angeles, CA

- Matawan, NJ

- Melbourne

- Mexico City

- Nairobi

- New York, NY

- Perth

- Phoenix, AZ

- Rio de Janeiro

- San Diego, CA

- San Francisco, CA

- San Jose

- São Paulo

- Shanghai

- Sheffield

- Silicon Valley, CA

- Singapore

- Sydney

- Toronto

- Detroit, MI

- Washington, DC

- Zurich

Related offices

- Atlanta, GA

- Auckland

- Beijing

- Bengaluru

- Boston, MA

- Brisbane

- Brussels (Benelux)

- Chicago, IL

- Miami, FL

- Dallas, TX

- Doha

- Dubai (DIFC)

- Frankfurt

- Hong Kong

- Houston, TX

- Irvine, CA

- Johannesburg

- Kochi

- Kuala Lumpur

- London

- Los Angeles, CA

- Matawan, NJ

- Melbourne

- Mexico City

- Nairobi

- New York, NY

- Perth

- Phoenix, AZ

- Rio de Janeiro

- San Diego, CA

- San Francisco, CA

- San Jose

- São Paulo

- Shanghai

- Sheffield

- Silicon Valley, CA

- Singapore

- Sydney

- Toronto

- Detroit, MI

- Washington, DC

- Zurich

Explore more at Fragomen

Media mentions

Senior Manager Kelly Hardman discusses Scotland’s hospitality sector following the UK government’s increase to the salary threshold for Skilled Worker visas.

Blog post

Manager Russell Hodges and Immigration Paralegal Natalia Jozwiak discuss the future of the UK's science sector following the country's 2024 re-entry into the Horizon programme and shift in migration policy.

Media mentions

Partner Charlotte Slocombe discusses what is considered US residency now that Prince Harry has changed his primary residence from the UK to US.

Media mentions

Director Willys Mac’Olale shares the impact the AfCFTA will have on Kenya’s economy and immigration policies.

Video

Immigration Consultant Laura Varon Osorio explains the process for posting foreign workers to France during the eagerly awaited 2024 Olympic and Paralympic Games in Paris.

Media mentions

Partner Daniel Pierce shares how a Supreme Court visa denial case could impact challenges to employment-based visa denials.

Awards

Partner Kevin Miner is selected by the Daily Report as a finalist in the “Legal Innovators” category of the publication’s 2024 Southeastern Legal Awards.

Blog post

This blog considers how employer sponsorship of long-term residence permits in Europe could be a means for retaining their talent.

Blog post

This blog provides an overview of Switzerland's family reunion process for EU/EFTA nationals and third-country nationals.

Awards

Four Fragomen professionals are recognised in the 2025 edition of The Best Lawyers in Australia in the field of immigration law.

Media mentions

O Diretor de Imigração, Diogo Kloper, compartilha quais indústrias estão recrutando talentos estrangeiros no Brasil.

Blog post

Partner Rahul Soni and Senior Associate Xiaodan (Susan) Song help international commercial enterprise investors make informed decisions by explaining the differences between EB-5 rural projects and high unemployment projects.

Media mentions

Senior Manager Kelly Hardman discusses Scotland’s hospitality sector following the UK government’s increase to the salary threshold for Skilled Worker visas.

Blog post

Manager Russell Hodges and Immigration Paralegal Natalia Jozwiak discuss the future of the UK's science sector following the country's 2024 re-entry into the Horizon programme and shift in migration policy.

Media mentions

Partner Charlotte Slocombe discusses what is considered US residency now that Prince Harry has changed his primary residence from the UK to US.

Media mentions

Director Willys Mac’Olale shares the impact the AfCFTA will have on Kenya’s economy and immigration policies.

Video

Immigration Consultant Laura Varon Osorio explains the process for posting foreign workers to France during the eagerly awaited 2024 Olympic and Paralympic Games in Paris.

Media mentions

Partner Daniel Pierce shares how a Supreme Court visa denial case could impact challenges to employment-based visa denials.

Awards

Partner Kevin Miner is selected by the Daily Report as a finalist in the “Legal Innovators” category of the publication’s 2024 Southeastern Legal Awards.

Blog post

This blog considers how employer sponsorship of long-term residence permits in Europe could be a means for retaining their talent.

Blog post

This blog provides an overview of Switzerland's family reunion process for EU/EFTA nationals and third-country nationals.

Awards

Four Fragomen professionals are recognised in the 2025 edition of The Best Lawyers in Australia in the field of immigration law.

Media mentions

O Diretor de Imigração, Diogo Kloper, compartilha quais indústrias estão recrutando talentos estrangeiros no Brasil.

Blog post

Partner Rahul Soni and Senior Associate Xiaodan (Susan) Song help international commercial enterprise investors make informed decisions by explaining the differences between EB-5 rural projects and high unemployment projects.