Freelance Licence in the UAE: What You Need to Know in 2025

May 19, 2025

By: Elena Caron

The UAE has emerged as one of the most attractive destinations for freelancers looking to formalise their work and tap into a thriving business ecosystem. With an expanding digital economy, flexible visa options and a growing pool of remote talent, securing a freelance licence in the UAE is not only accessible—but increasingly strategic.

This blog outlines the eligibility, cost, benefits and important points to consider before applying for a freelance licence in the UAE in 2025.

What is a freelance licence?

A freelance licence is a government-issued permit that allows individuals to operate as independent professionals in specific sectors without the need to set up a full company or sponsor employees.

The licence allows freelancers to work legally, invoice clients, access business services and, if needed, apply for a residence visa tied to a freelance licence.

Who can apply for a freelance licence?

Freelance licences in the UAE are available for both residents and non-residents across a variety of sectors, such as:

-

-

- Media and creative (photographers, writers, marketers)

- Tech (developers, cybersecurity experts, UI/UX designers)

- Education (trainers, tutors, curriculum consultants)

- Business support (HR, legal, finance consultants)

- E-commerce

- Influencers/promotors

-

Salaried employees in the UAE can apply, provided a No Objection Certificate (NOC) is obtained from the current employer.

Which jurisdictions offer a freelance licence in the UAE?

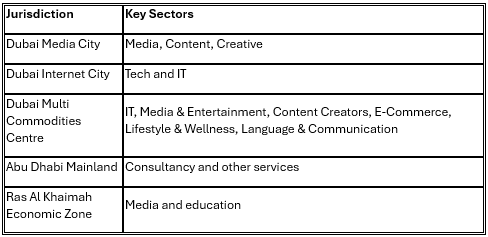

Multiple jurisdictions across the UAE offer freelance permits. Popular options include:

Is a residence visa available with a freelance licence?

Yes, if required, a freelance residence permit can be secured based on the licence. The residence visa is typically valid for one or two years and usually includes:

-

-

- Licence/permit

- Establishment card

- Residence permit and Emirates ID card (if opted)

-

This is a valuable option for digital nomads and remote professionals seeking for a stable legal base in the UAE.

How much does a freelance licence cost?

Government fees vary significantly based on the chosen jurisdiction and whether a residence permit is required. Costs in 2025 range from:

-

-

- Approximately AED 1,800 (USD 490) for the licence alone

- Up to AED 14,200 (USD 3,866) for the licence with a visa

-

Benefits of holding a freelance licence in the UAE

-

-

- 100% ownership: No need for a local sponsor

-

-

-

- Access to clients: Freelancers can open a personal bank account and invoice legally

- Tax efficiency: The UAE has no personal income tax, though corporate tax applies in certain cases

- Business credibility: Being licenced builds trust with clients and institutions

- Sponsoring dependents: Freelancers with residence permits can sponsor dependents

-

Considerations for applying

-

-

- Annual renewal fees apply

- Some free zones limit the number of activities per licence

- A No Objection Certificate (NOC) may be required for applicants already employed in the UAE

- New regulations on corporate tax may apply depending on income structure

- A legalised education certificate may be required

- Hiring employees under a freelance licence is not permitted

-

How Fragomen can support freelancers in the UAE

The UAE’s flexible and business-friendly freelance system makes it one of the best places in the region to formalize solo careers. As competition grows and regulations evolve, having the right structure from day one is essential. Fragomen’s Corporate Services team can help navigate the best jurisdiction, licencing options and visa pathways.

Need to know more?

For further information, please visit Fragomen’s Corporate Services page or fill out the form below to contact our team and begin your UAE freelance licence journey.

This blog was published on 19 May 2025, and due to the circumstances, there may be frequent changes. To keep up to date with all the latest updates on global immigration, please subscribe to our alerts and follow us on LinkedIn, X, Facebook and Instagram.