Countries / Territories

- 🌐

Related contacts

Managing Partner, Europe

Related offices

Related content

Related contacts

Managing Partner, Europe

Related offices

Related content

Related contacts

Managing Partner, Europe

Related offices

Related content

As a ‘No Deal’ Brexit remains a distinct possibility, companies need to understand the potential implications, especially with regard to short and long term mobility of their employees. An area of major significance which is often not sufficiently headlined is the significant impact a hard Brexit may have on the salary cost and the social security cost of the employees travelling to and from the UK, for both employer and the individual.

In principle, a worker is subject to social security contributions in the country in which they work. An important exception to this is in the case of a ‘posting’, i.e. when a worker carries out duties on a temporary basis in another country, in the interest of his/her employer, and when the worker is not replacing another ‘posted’ worker to the same entity. In such a case, a worker could maintain social security coverage in their Home country for a limited period of time, without becoming liable for additional social security costs in their Host country.

These exceptions are laid down in international social security agreements, such as the EU Regulations on the coordination of social security systems, which currently apply to all EU and EEA member states (including the UK) and Switzerland. As of Brexit day, in case of ‘No Deal’, the EU Regulations, allowing the ‘posting’ exception, would cease to apply to the UK. Therefore, the risk of an employee going between the UK and the EU becoming liable to social security in both the EU and the UK is very real.

‘Old’ Bilateral Social Security Agreements

In principle, one solution to the social security challenges post ‘No Deal’ Brexit could be reviving the existing ‘old’ social security agreements that the UK concluded with a number of EU member states in the past. The legal validity of their revival is a legal question, which is still being debated in many countries. However, even if such agreements were deemed still valid, consideration must be given as to whether they can be easily adapted to reflect the dynamics and characteristics of the modern day mobile workforce.

Domestic Social Security Legislation

In the absence of any ‘old’ bilateral social security agreements, and unless new ones are made, the UK will be treated as a non-EU country from a social security perspective by the EU member states. This means that the social security implications in a cross border work situation would need to be addressed by looking at both the domestic legislation of the sending country as well as the domestic legislation of the receiving country.

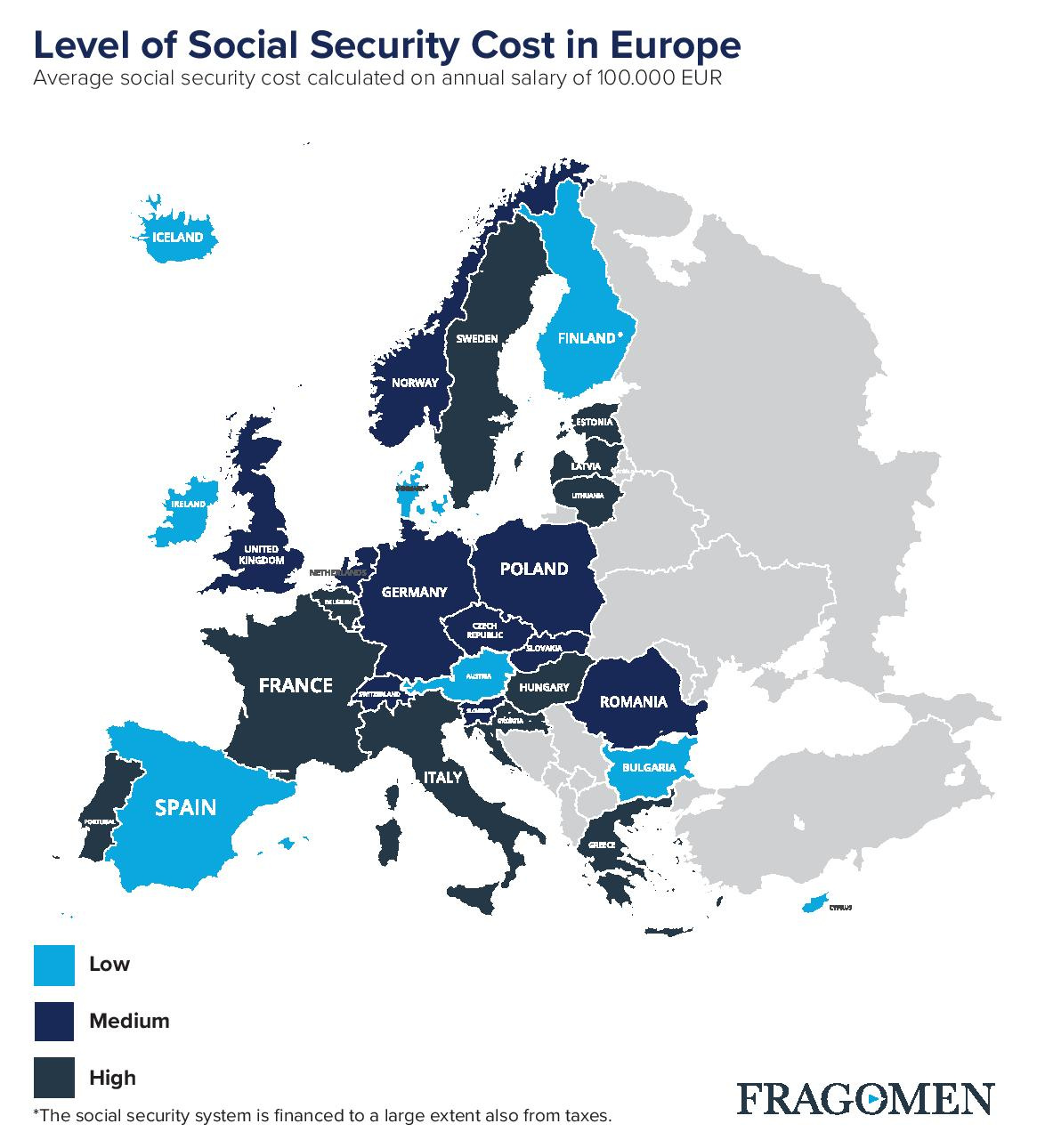

For example, a UK worker ‘posted’ to France for a temporary period of time could become liable to French high-cost social security contributions, in addition to having continuing liability in the UK. Moreover, depending on the individual circumstances of the actual cross-border employment set-up, the posted worker may also not reach minimum social contributions to qualify for future pension benefits in the UK or France. In most jurisdictions, the social security contributions paid into the system during a period of work cannot be refunded at the moment of departure from the country at the end of the posting period.

Next Steps

With informed advance planning, companies can put strategies in place to avoid a ‘No Deal’ or hard Brexit becoming an overwhelming experience. A solid strategy can also help to manage the impact and expectations of their workers in relation to social security and protect salaries (and salary costs) from being impacted by a change in social security costs.

To minimize the significant cost impact of a ‘No Deal’ or hard Brexit on the social security cost of a mobile workforce, and the potential need to compensate for the loss of social security entitlements (e.g. pension rights, protection of access to medical care), companies need to assess the implications, plan in advance and inform internal stakeholders appropriately:

- Assess: Conduct an in-depth internal analysis of the posting status quo to understand potential negative social security implications such as double liability costs could be mitigated by adjusting the contractual arrangements and assignment structures.

- Plan: Prepare hypothetical cost projections reflecting the most frequently occurring cross-border traveller profiles and patterns.

- Inform: Continuous communication with internal stakeholders, line managers, HR, global mobility, finance, and frequent business travellers is critical in creating awareness around the impact of Brexit on social security and to budget for increased costs, stricter compliance and increased reporting.

Countries / Territories

- 🌐

Related contacts

Managing Partner, Europe

Related offices

Related content

Related contacts

Managing Partner, Europe

Related offices

Related content

Related contacts

Managing Partner, Europe

Related offices

Related content

Explore more at Fragomen

Blog post

Senior Business Immigration Consultant Ryaihanny Sahrom and Business Immigration Consultant II Fahimah Muhammad examine Indonesia’s newly launched Global Citizenship of Indonesia (GCI) program and its introduction of long-term and indefinite permanent residence pathways for members of the Indonesian diaspora.

Media mentions

Senior Immigration Manager Jonathan Hill notes that tighter UK visa compliance rules and new rating measures create additional challenges for universities.

Video

Partner Diana Quintas outlines key early career visa pathways and practical considerations for employers and graduates navigating entry-level immigration options.

Fragomen news

The Montreal office has added Partner Julie Lessard and Counsel Elsa Agostinho and Sophia Khanzadian to strengthen its immigration services.

Blog post

Destination Services Director Christine Sperr examines how housing market reforms, rent stabilization measures and cost-of-living dynamics in Saudi Arabia are influencing workforce mobility, compensation planning and long-term settlement strategies under Vision 2030.

Blog post

Manager Dr Adela Schmidt and Senior Associate Isabel Schnitzler analyse the European Commission’s infringement proceedings against Germany concerning its Vander Elst visa requirements for third-country nationals providing short-term cross-border services and explain why current compliance obligations remain unchanged.

Blog post

Latin America & the Caribbean Managing Partner Leonor Echeverria, Senior Associates Sarah Blackmore and Sonya Cole and Senior Regional Knowledge Manager Laura Weingort examine renewed energy interest in Venezuela and outline key immigration pathways, procedural constraints and strategic considerations for compliant talent deployment.

Media mentions

Senior Manager Andreia Ghimis highlights how the EU’s new migration strategy could create opportunities for employers while increasing compliance requirements.

Awards

Partner Julia Onslow-Cole is recognised in the Spears 500 guide to leading private client advisers, reflecting her experience advising high-net-worth individuals, families and global businesses on complex UK and European immigration and mobility strategies.

Media mentions

Partner Abeer Al Husseini discusses increased scrutiny of Saudi business visas in AGBI, highlighting stricter review of short-term entry used for operational work and the implications for regional employers.

Awards

Australia and New Zealand Managing Partner Teresa Liu, Partner Charles Johanes, Practice Leaders Hedvika and Leader Ben Lear and Senior Associate Hannah Scanlan are recognized in the 2026 edition of Doyle’s Guide as leading immigration practitioners in Australia.

Awards

Fragomen is ranked Band 1 for Immigration: Business in the Chambers Global 2026 Guide, marking two decades of recognition since 2006. The firm is also the only firm ranked Band 1 in the Global: Multi-Jurisdictional Immigration category and receives additional individual recognitions in the USA: Business Immigration rankings.

Blog post

Senior Business Immigration Consultant Ryaihanny Sahrom and Business Immigration Consultant II Fahimah Muhammad examine Indonesia’s newly launched Global Citizenship of Indonesia (GCI) program and its introduction of long-term and indefinite permanent residence pathways for members of the Indonesian diaspora.

Media mentions

Senior Immigration Manager Jonathan Hill notes that tighter UK visa compliance rules and new rating measures create additional challenges for universities.

Video

Partner Diana Quintas outlines key early career visa pathways and practical considerations for employers and graduates navigating entry-level immigration options.

Fragomen news

The Montreal office has added Partner Julie Lessard and Counsel Elsa Agostinho and Sophia Khanzadian to strengthen its immigration services.

Blog post

Destination Services Director Christine Sperr examines how housing market reforms, rent stabilization measures and cost-of-living dynamics in Saudi Arabia are influencing workforce mobility, compensation planning and long-term settlement strategies under Vision 2030.

Blog post

Manager Dr Adela Schmidt and Senior Associate Isabel Schnitzler analyse the European Commission’s infringement proceedings against Germany concerning its Vander Elst visa requirements for third-country nationals providing short-term cross-border services and explain why current compliance obligations remain unchanged.

Blog post

Latin America & the Caribbean Managing Partner Leonor Echeverria, Senior Associates Sarah Blackmore and Sonya Cole and Senior Regional Knowledge Manager Laura Weingort examine renewed energy interest in Venezuela and outline key immigration pathways, procedural constraints and strategic considerations for compliant talent deployment.

Media mentions

Senior Manager Andreia Ghimis highlights how the EU’s new migration strategy could create opportunities for employers while increasing compliance requirements.

Awards

Partner Julia Onslow-Cole is recognised in the Spears 500 guide to leading private client advisers, reflecting her experience advising high-net-worth individuals, families and global businesses on complex UK and European immigration and mobility strategies.

Media mentions

Partner Abeer Al Husseini discusses increased scrutiny of Saudi business visas in AGBI, highlighting stricter review of short-term entry used for operational work and the implications for regional employers.

Awards

Australia and New Zealand Managing Partner Teresa Liu, Partner Charles Johanes, Practice Leaders Hedvika and Leader Ben Lear and Senior Associate Hannah Scanlan are recognized in the 2026 edition of Doyle’s Guide as leading immigration practitioners in Australia.

Awards

Fragomen is ranked Band 1 for Immigration: Business in the Chambers Global 2026 Guide, marking two decades of recognition since 2006. The firm is also the only firm ranked Band 1 in the Global: Multi-Jurisdictional Immigration category and receives additional individual recognitions in the USA: Business Immigration rankings.