The UK’s Semiconductor Moment: Why Immigration Policy Must Keep Up

March 25, 2024

By: Charlotte Wills

The UK’s semiconductor sector is gaining momentum. Whilst the government’s National Semiconductor Strategy launched in 2023 was met with a muted reception for a perceived “lack of ambition,” it plays a key role in the UK’s goal of being a science and technology superpower.

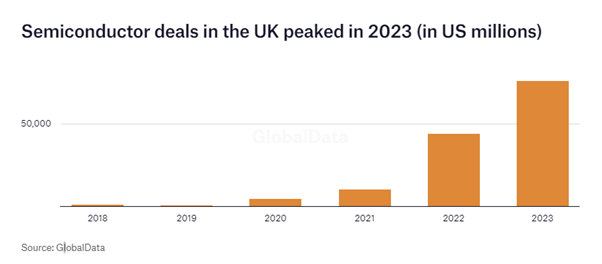

The semiconductor industry has truly global reach and the UK’s contribution lies in its strength and skills in design, research and development and compound semiconductors. As the sector continues to experience explosive growth, the UK’s economy will reap the rewards. In fact, the total value of semiconductor deals in the UK totalled $75.8bn in 2023 (a significant increase over 2022 which saw deals total $44b) and after years of uncertainty, US electronics company, Vishay acquired the Newport fab in Wales, the largest in the UK, in early March.

Additionally, on 13 March, the government announced that British semiconductor researchers and businesses will have enhanced access to research funding backed by the UK government and Horizon Europe, with the UK joining the EU’s Chips Joint Undertaking. The initiative will provide the UK with access to a 1.3 billion Euro Horizon funding pot for collaborative semiconductor research projects, a welcome development for the sector and a further signal of the UK’s attempts to claim its position in the global chip supply chain.

This latest announcement comes on the heels of the February 2024 creation of Innovation and Knowledge Centres in Southampton and Bristol, which will receive £11 million each to help bring new chip technologies to market. Each focuses on an area of British leadership on the world stage – silicon photonics and compound chips – as the UK attempts to deliver its £1 billion semiconductor strategy. At the same time, £4.8 million in funding for semiconductor skills projects were also announced.

Staffing the Semiconductor Boom

The UK’s semiconductor ambitions can only be met by ensuring the industry has a skilled labour force in place—and the UK must do more to sustain and grow the pipeline of talent. A survey by the UK Electronic Skills Foundation found that 63% of surveyed employers in the compound semiconductor market have experienced skills shortages. Additionally, more than 80% of UK companies with any semiconductor design capability are seeking new engineers, with over 1,000 current vacancies.

Yet in December 2023, the Home Secretary unveiled an ambitious five-point plan aimed at reducing net migration, due to take effect on 4 April 2024, and likely to have widespread consequences across many UK sectors.

Upcoming Changes to the UK Immigration Landscape

The proposed salary changes for individuals relocating to the UK for work under the Skilled Worker route will impact the UK’s semiconductor potential, especially in the availability of engineers and other STEM talent via the Skilled Worker route by:

- increasing the current ‘general salary threshold’ of the Skilled Worker immigration category from £26,200 to £38,700 and increasing the going rate to the median; and

- reforming the Shortage Occupation List (SOL) by removing the 20% discount to the ‘going rate’ minimum salary for SOL roles and introducing a new condensed Immigration Salary List (ISL).

In addition, The Migration Advisory Committee (MAC) has also recommended that some of the roles historically included on the Shortage Occupation List, which is used by the science and tech industries, be removed from the new Immigration Salary List. If these recommendations are adopted by the government, the current 20% discount to the ‘going rate’ minimum salary will no longer be available to employers.

Consequences for the UK’s Semiconductor’s Success Story

The UK’s strategy for the sector acknowledges that the UK should be an attractive destination for international talent and that the UK Semiconductor Advisory Panel should ensure government, academia and industry work together across the sector to achieve this.

The recruitment of talented engineers from across the world should be a part of that, with UK employers making use of ‘unsponsored’ visa schemes such as the High Potential Individual Visa, Scale-Up Visa, and Global Talent Visa. However, the government’s recent commission to the Migration Advisory Committee to review the Graduate Visa Route, could see yet another blow to existing pathways currently available to attract the international talent required to nurture a thriving, competitive industry. The findings of that review are expected mid-May 2024.

Looking Ahead

The changes expected to UK immigration pathways in April 2024 will likely reduce net migration figures – but at what expense to those sectors seen as a priority to the future success of the UK on the global stage, especially for the ambition of the semiconductor industry?

In the short term, those within the sector who are responsible for recruitment and defining talent pipelines should start assessing their current and future recruitment needs and identify roles that may be affected by these changes.

The semiconductor industry should also be ready to contribute to the MAC’s wider stakeholder review on the benefits of the Immigration Salary List, expected later this year. That review will provide a further opportunity for businesses in important sectors falling within cohorts impacted by the rise in salary thresholds and suffering from skills shortages to make their case for a balanced immigration system that supports the needs of business and the UK economy as well as encouraging the development of grass route STEM talent.

Need to Know More?

For more information on the UK semiconductor industry, please contact Partner Charlotte Wills at [email protected].

This blog was published on 25 March 2024, and due to the circumstances, there are frequent changes. To keep up to date with all the latest updates on global immigration, please subscribe to our alerts and follow us on LinkedIn, X, Facebook and Instagram.